Summary

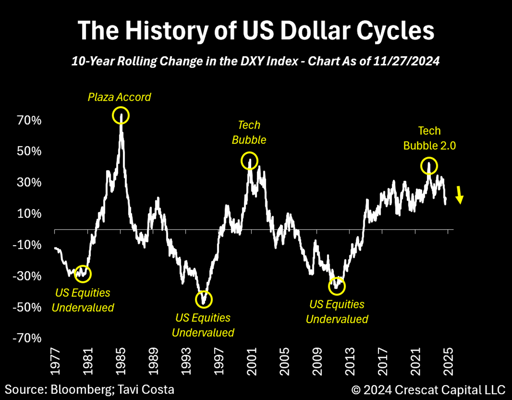

- The cyclical nature of the US dollar, driven by fiscal and monetary policy constraints, suggests a significant downward transition is imminent.

- Historical trends show dollar downturns favor gold, undervalued international equities, and commodities, with emerging markets gaining prominence.

- US equities are excessively overvalued, signaling a potential capital shift to undervalued and overlooked global markets, including emerging markets.

- The mining industry, particularly gold and silver, is poised for a resurgence due to macroeconomic shifts and potential policy changes under the Trump administration.

You must log in or register to comment.