Still very bleak. Nobody is retiring comfortably on $60k, much less $10k.

Might be worth factoring in SS, as that’s the real practical retirement savings people rely upon.

Still very bleak. Nobody is retiring comfortably on $60k, much less $10k.

Might be worth factoring in SS, as that’s the real practical retirement savings people rely upon.

Social Security was the single greatest transfer of wealth from employers to employees in US history

Conservatives spent the last quarter century screaming “Muslims are the worst, they’re going to kill us all!”

Liberals smugly retorted “Actually you Christians are slightly worse”, and then proceeded to shit the bed in the next 9 of 12 elections.

The moral they took away from this story is that a woman should never run for president.

The $8 tier has been around for a decade, for exactly this reason. MMO subscriptions, bargain games, podcasts, delivery fees. People love charging you $8

The biggest challenge I have with pirated games - especially Nintendo games - is the controller.

Yeah, I can get Metroid Prime or Mario 64 or Super Smash easily enough. But I can’t have that classic experience on a PS knock off controller.

It’s not the end of the world, of course. But I feel it.

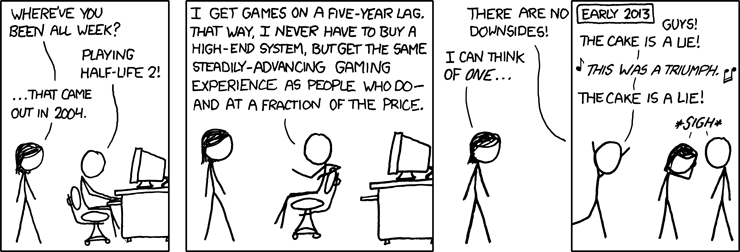

You can always do the XKCD trick

But even this seems to have gone stale over time, as retro game prices get sticker (even going up as vintage games come back into fashion).

One thing I don’t see on this list is “piracy”, which is a bit weird if your line is $15. I find a lot of bargain bin games to be as bad or worse than FTP games. $20-30 has historically been my sweet spot

Glances at this guy’s main() function

Instantly dies

It’s been a feature of the US prison system since the end of Reconstruction. This isn’t something Trump invented.

Bright Blue California rejected a measure to ban prison slavery just a year ago.

Bumbling trigger happy halfwit goons are a feature, not a bug. The police, as an organization, exist to guard private property not human life. They are supposed to be a source of social terror and stochastic violence. They are supposed to horrify people they patrol, not help them.

A lot of people I know have a strict “Never call the police” personal policy for reasons adjacent to this.

The Super Adventure Club episode exploded into my brain halfway through One Battle After Another when they drop “The Christmas Adventurers Club” on me like a nuclear warhead.

The Adam Friedland Show hitting new levels of Super Sayan off this shit.

Nevermind TrueAnon

SNL just did a skit on this.

We already have a ton of names. Nobody is getting burned.

Love to give a President the Nobel Prize inside the first six weeks on the job.

Remember how well that worked out for Obama?

The largely clandestine effort, profiled in a New York Times report and a forthcoming book by Newsweek’s Daniel Klaidman, highlights a remarkable transformation for a man who campaigned four years ago as an anti-war Senator, former law professor and defender of Constitutional due process. He pushed for an end to the use of torture on terror suspects, the closure of the Guantanamo Bay military prison, and for trying detainees in federal courts. For those efforts he won the Nobel Peace Prize.

Yet over the past three and a half years, Obama has sat quietly “at the helm of a top secret ‘nominations’ process to designate terrorists for kill or capture, of which the capture part has become largely theoretical,” according to the Times. He personally vetted names on a “kill list” of targets, authorizing dozens of drone strikes even in cases with only vague and inconclusive evidence about who’s really on the ground, according to the report. Neither the evidence against the suspects nor the suspects’ identities is available for public scrutiny.

So he’s going to win the Nobel?

Hatchet Man’s job is done.

Time to cash out and move on to the next gig